by Robert Fedderson | Aug 1, 2018 | Power User Profile, Prospect Research

Cristina Naccarato is an experienced prospect researcher at the Art Gallery of Ontario (AGO) and active member of the Association of Professional Researchers for Advancement Canada (APRA). Cristina first began using CharityCAN as a student at the University of Western Ontario (UWO) and made it a priority to advocate for a CharityCAN subscription when she began her position at AGO.

Use

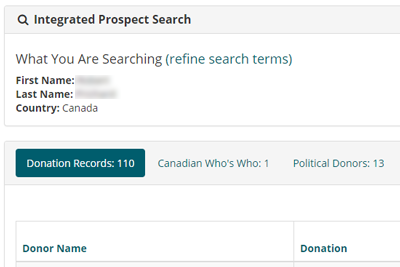

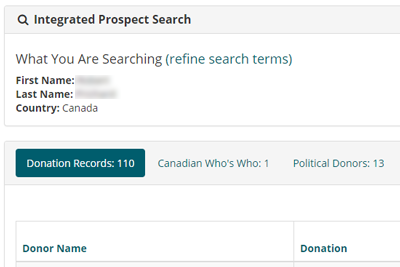

I use CharityCAN in a variety of ways. It’s always the first place I go whenever I come across a new potential prospect. I put the name into the integrated search and use the results to guide the rest of my research. I find it provides a great overview of a prospect, but also gives me the ability to check the other data sets to find more information when necessary.

Features

I love Relationship Paths. I use it regularly to see how new prospects, or even foundation boards, are connected to our trustees. I’ve found a lot of great connections using the tool and it has helped my Major Gifts team get closer new prospects.

Data

I use the donation records every day. I find them super easy to customize and sort. I also love that they provide links to the source information.

In Action

CharityCAN has helped me with almost all of my “big wins!” Here is one of my favourite stories: I was doing research on a prospect and using the Charity Research tools I noticed a very large donation to a large Ontario university, but from what I could tell, this prospect had no other ties to the university. Further, all of the prospect’s giving was in Toronto and Montreal and this university is in neither of those cities. This lead me to do some further research where I found out the prospect made the donation to a specific school at the university. This lead me to uncover a cause the prospect has a strong affinity for.

This was a prospect we haven’t had any affiliation to in years, and we were in the middle of a campaign. An element of that campaign was a project that aligned very well with the affinity I uncovered by digging up info on the university donation. The prospect loved the idea I suggested, supported the project, and even ended up joining our board. This prospect (now donor and board member) has been very involved ever since. CharityCAN helped me uncover this interest and helped with all of the strategy that went into the ask.

If you would like to be a featured power user send us an email at info@charitycan.ca!

by Robert Fedderson | Jun 15, 2018 | Prospect Research, Relationship Mapping

The proximity principle suggests we form our strongest relationships with people close to us. This is fairly intuitive. Most of us would point to the people close to us – family, friends, neighbours, colleagues – as the strongest relationships in our lives. These relationships can be very influential. The way we think and act is strongly influenced by the people close to us. Our behaviour is, to a certain extent, dictated by the people around us.

Why is this relevant to a fundraising organization?

Fundraising organizations can leverage the proximity principle by looking at the people close to their donors. A major gift donor’s family, friends, neighbours and colleagues are influenced by the major gift donor and vice versa. They are close to each to other and they have formed strong, influential relationships.

How can we find people in close proximity to our donors?

Colleagues

In Canada, many major gift donors give both time and money to charities. They sit on charity boards and, in many cases, corporate boards. Realizing these connections is a powerful fundraising tool. Look at the boards your major gift donors sit on and then look at the other people on those boards. They have a relationship with your major gift donor and are likely influenced by your major gift donor. There is a good chance these people can become your next major donor.

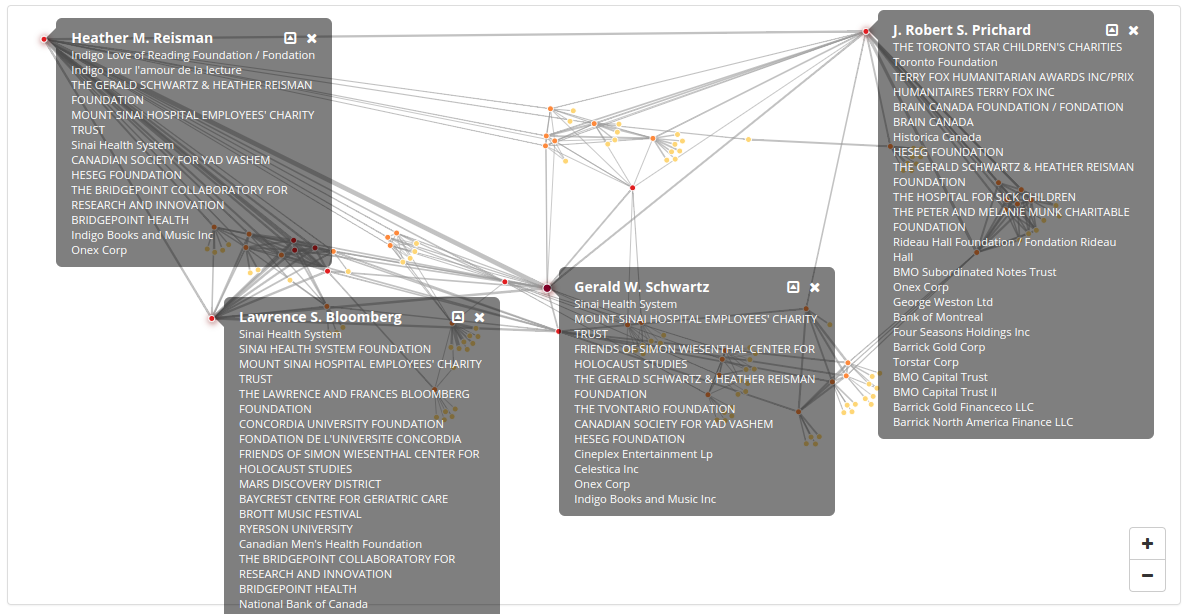

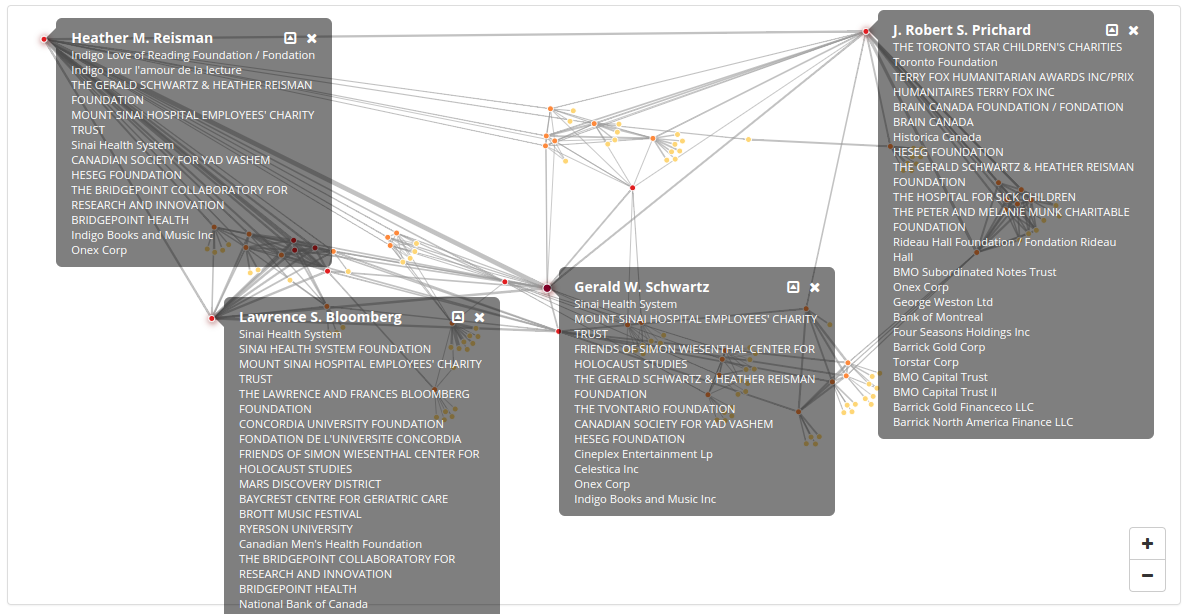

Let’s take a look at some of the board connections of one of Canada’s most generous philanthropists, Gerald Schwartz. Note: this list includes historical and current board memberships.

Charity Boards:

- Sinai Health System

- Mount Sinai Hospital Employees’ Charity Trust

- Friends of Simon Wiesenthal Center for Holocaust Studies

- The Gerald Schwartz and Heather Reisman Foundation

- The TVOntario Foundation

- Canadian Society for Yad Vashem

- Heseg Foundation

Corporate Boards

- Indigo Books & Music Inc

- ONEX Corporation

- Bank of Nova Scotia

- Celestica Inc

- Constellation Brands Canada Inc

- Loews Cineplex Entertainment Corp

- Scotia Mortgage Investment Corporation

Judging by these positions, Gerald Schwartz is connected to a number of people who will be of interest to a fundraising organization. Mapping these relationships will allow us to see who Mr. Schwartz is in closest “proximity” to and allow us to see if those connections are worth looking into further.

I generated this map using CharityCAN’s relationship map function and CRA and Corporate Canada data. Alternatively, this could be done by pulling CRA data and relevant management proxy circulars and manually creating a relationship map.

As we can see from this relationship map, there are a number of people in proximity to Gerald Schwartz who are plausible major gift prospects. This example illustrates how fruitful understanding who is in proximity to your major donors, board members, or any other friend of your organization can be.

Neighbours

Another way fundraisers can use proximity to find new prospects is by examining who lives close to their major donors. Postal code analysis is the easiest way to do this. Simply cross reference a new prospect’s postal code against your donor database and see if your prospect lives in the same neighbourhood as any of your major donors. This can be a valuable indicator of proximity influence as well a useful conversation starter.

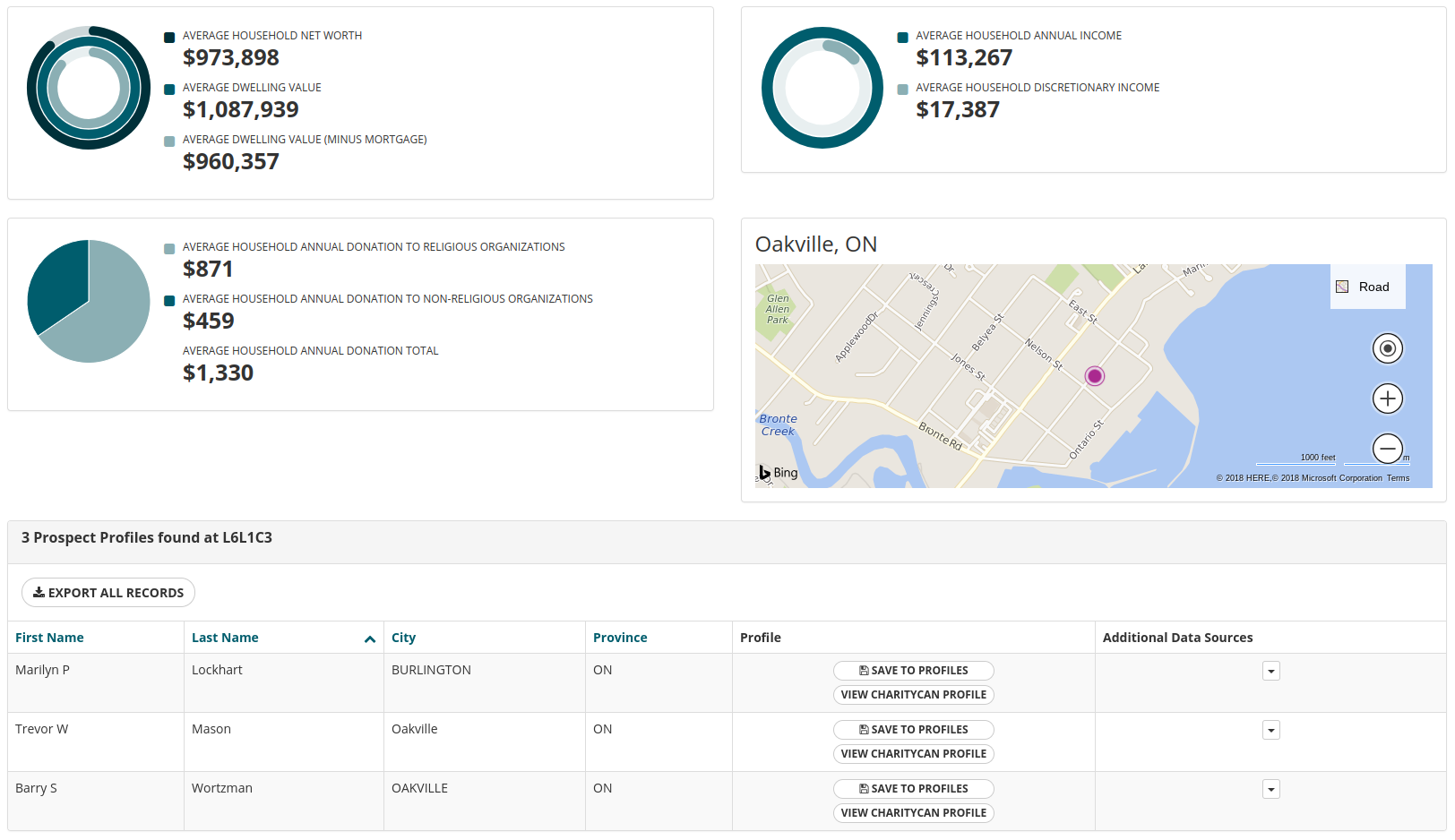

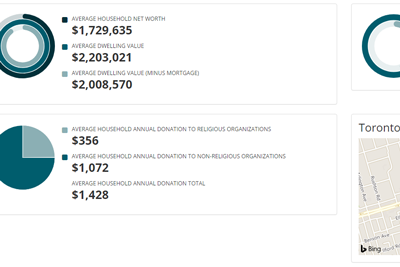

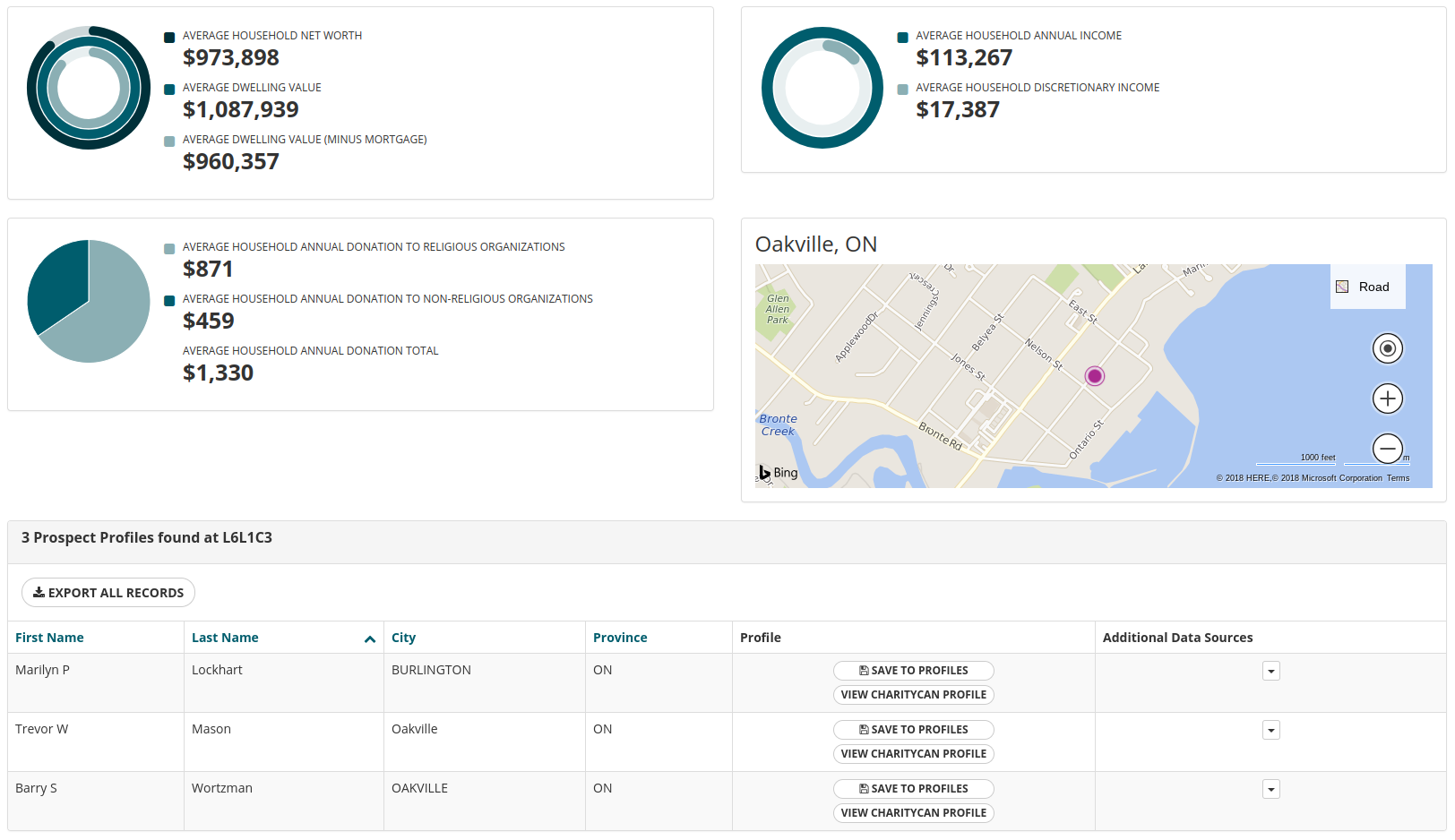

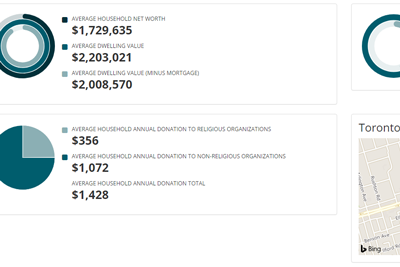

CharityCAN’s postal code lookup tool can do this quickly, as well as show you important wealth indicators such as average dwelling value, discretionary income, and donations for that postal code. In the example below, I did a lookup on the postal code of a fictional major donor. In addition to the wealth indicators, this search shows me three other potential donors who live in the same neighbourhood as my major donor.

The above examples make a strong case that proximity research is prospect research time well spent. Looking at who is in proximity to our major gift donors can quickly generate a list of prospects worthy of further research. Finding out who your donors colleagues and neighbours are can be the first step to finding your next major gift donor.

by Robert Fedderson | Apr 24, 2018 | Guide, Prospect Research, Relationship Mapping

Prospect research is necessary for fundraising organizations of all sizes. Identifying, understanding, and connecting with potential donors – whether they are individuals, granting foundations, or corporations – is critical to the success of modern charities and non-profits. Fundraising without prospect research is like travelling without directions. If you do get to your destination, your trip was certainly more difficult than it had to be. Fundraising without prospect research consumes unnecessary resources, is less predictable, and perhaps most importantly, brings in fewer dollars.

Successful prospect research means being able to answer the following questions about your prospective donors as efficiently and accurately as possible:

- Do they engage in philanthropy?

- What are their philanthropic focus areas?

- Do they have the ability to make a gift that fits the goals of my organization?

- Does my organization have a connection to them we can use to create a meaningful relationship?

In this guide, we will introduce you to the fundamental elements of prospect research by looking at propensity, capacity, affinity, and connection.

Propensity

Propensity is the inclination or tendency to behave a certain way. As it relates to prospect research and fundraising, it refers to the inclination or tendency to make donations to charitable causes and organizations. Simply put, if someone has never given a charitable gift their propensity to make charitable donations is a quite low, whereas if someone is a monthly donor to a variety of causes their propensity to make charitable donations is quite high.

The easiest way to quickly gauge propensity is by examining donation history. This is best accomplished by examining internal donation records so you have a sense of how often the prospect gives to your organization and external donation records so you have a sense of how often the prospect gives to other organizations.

Another useful way to gauge propensity is by looking at how your prospect spends his or her time. This method is less useful with corporate or granting foundation prospects, but can be invaluable when assessing an individual’s propensity. The following questions are instructive:

- Has my prospect spent any time on the board of a charity or a non-profit?

- Is my prospect politically active?

- Is my prospect active in the community?

These questions will help determine if your prospect has the inclination to donate a valuable a resource – time – to pursuits beyond self-interest. Public service can be a powerful indicator of how an individual views his or her role in society and his or her propensity for charitable engagement.

Affinity

Affinity is best described as fondness or liking. In fundraising, affinity can be understood as a fondness for your mission or organization. If 100% of a foundation’s grants have been awarded to organizations supporting animal welfare, that foundation has a strong affinity for organizations that support animal welfare. As with propensity, donation records are great way to begin to gauge affinity.

When considering affinity, it is important to understand the difference between mission and organization. Consider the following: an individual has a donation history that is comprised entirely of gifts to her alma mater. Does this individual have an affinity for education as a cause or mission or an affinity for this specific institution? It is probably inaccurate to say she has an affinity for post-secondary education as a cause, it is far more likely she has an affinity for the place she went to school.

Capacity

In fundraising, capacity refers to a prospect’s ability to give. Typically, capacity is measured by wealth. The wealthier a prospect, the greater the capacity to give. When looking at an individual donor, prospect researchers examine things like compensation, real estate holdings and other assets (and liabilities if possible) to determine capacity. For granting foundations, prospect researchers will look at revenue and expenses and assets and liabilities. Corporations get a little trickier, especially if private, but yearly revenue, cash, and assets and liabilities are all ways prospect researchers will determine capacity.

A major challenge prospect researchers face when determining capacity is total wealth. Unless you have access to a prospect’s entire financial history or he tells you (and you have reason to believe him), it is almost impossible to determine exact wealth.

Consider the following scenario. You are researching two prospective donors and have access to the reasonably accurate information about the market value of their homes. Prospect A owns a home with a market value of $2 million. Prospect B owns a home with a market value of $500,000. Simple enough, right? Prospect A has a greater capacity to give than prospect B. But what if prospect A has a mortgage of $1.7 million remaining on the home and prospect B paid for the home in cash and doesn’t carry a mortgage? Some of back of the napkin math shows that dwelling value minus mortgage for prospect A is $300,000 and dwelling value minus mortgage for prospect B is $500,000. Perhaps prospect B has the greater capacity after all. What if you also have compensation data for both prospects and last year prospect A received a total compensation package (salary, bonus, stock) from her employer of $600,000 and prospect B received a salary of $120,000? It looks like prospect A is back in the lead.

This example helps illustrate the primary challenges prospect researchers face when determining capacity: availability of information. Data on the market value of the properties is one piece of information that will likely paint an inaccurate portrait of the prospects’ capacity. Data on the market value of the properties plus mortgage liabilities gives us two pieces of information and our portrait starts to get more accurate. Data on property values, mortgage liabilities and compensation gives us three pieces of information and, probably, a reasonably accurate portrait of both prospects’ capacity to give.

Connections

Traditionally, prospect research has focused strictly on determining propensity, affinity and capacity and supplying research and data that supports those determinations. Connecting with potential donors has been left to fundraisers. This is changing. Data that reveals organizational connections and relationships is becoming more readily available. This is helping to make relationships and connections more quantifiable than they have ever been. Compare “a member of our board served on the board of a company we would like to approach for a sponsorship from 2009-2015” versus “I’m pretty sure they used to golf together.” The availability of objective data about connections is pushing relationship research under the purview of prospect researchers.

When researching relationships, your most important concern should be verifiable data. Treat relationship data like you would donation or compensation data and look for the best data available. T3010 data (the T3010 is the tax form required by the Canada Revenue Agency to be filed yearly by every registered charity and lists the individuals on the charity’s board of directors) and management proxy circulars (securities regulators require publicly traded companies to file circulars that list key officers, executives and board of directors members) are a great place to start researching connections and relationships. Both are legal documents listing the key people at the organizations; analyzing them can help you determine – from a wholly verifiable source – who knows who and how they are connected.

A very fruitful place to start looking for connections is your own board of directors. Almost all board members have – at the very least – an implicit fundraising mandate. Also, many board members serve on multiple boards, both charity and corporate. Mining the connections of your board of directors for relationships with people who sit on the boards of large companies or granting foundations can be the difference between an accepted sponsorship, gift or grant request and a rejected one.

Conclusion

Imagine you are tasked to create a list of donors with the potential of making a $10,000 gift to your organization. First, you need to determine propensity. You can do this by examining your list of prospects eliminating those that have never made a charitable gift. Second, you need to determine affinity. To do this, eliminate the names on the list who only give to organizations with dissimilar missions or have a well documented history of only giving to a single organization. Third, you need to determine capacity. To do this, use real estate, financial holdings, and compensation data to eliminate the names on the list who do not have the capacity to make a $10,000 gift. The names left on your list are reasonably well-qualified prospects to make a $10,000 gift to your organization. Finally, research connections and relationships to determine if your organization is linked in any way to the remaining names. The names you do have connections with should be prioritized for approach. They have the propensity to give, an affinity for your cause, the capacity to make a gift you are pursuing, and connections to your organization you can utilize in your approach. They are well-qualified prospects.

Understanding the fundamental aspects of prospect research will help you direct your research more efficiently. You will spend less time chasing down information of questionable value and more time finding verifiable data that helps answer the necessary questions about propensity, affinity, capacity, and connection.

by Robert Fedderson | Feb 3, 2018 | Guide, Prospect Research, Relationship Mapping

How does it work?

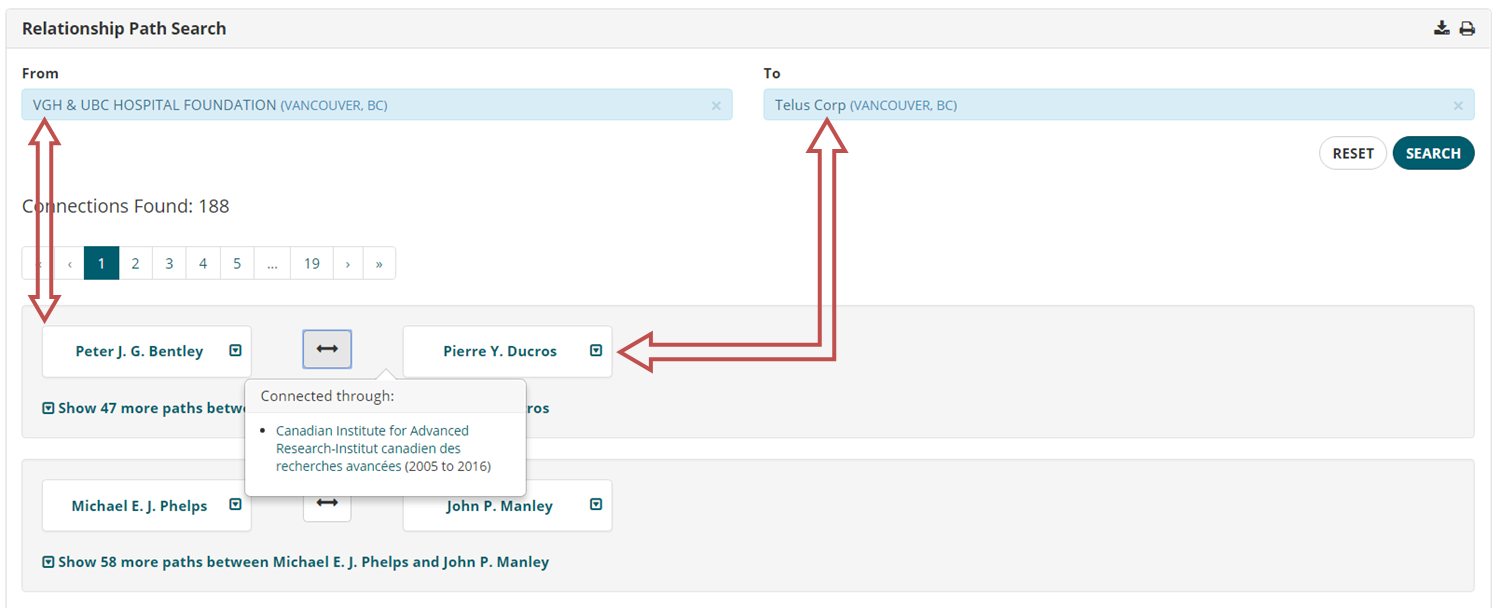

CharityCAN maps relationships between two people based on time spent together on charity and corporate boards. So, if two people were on the same charity or corporate board together at the same time, CharityCAN identifies and maps that relationship. If two people have been on multiple boards for multiple years, CharityCAN would identify that relationship as being stronger than if those same two people had only spent one year together on one board. Relationship Paths search takes that entire map and searches through all of those connections to find if and how people, charities, and companies are related and ranks them by connection strength.

Here is an example:

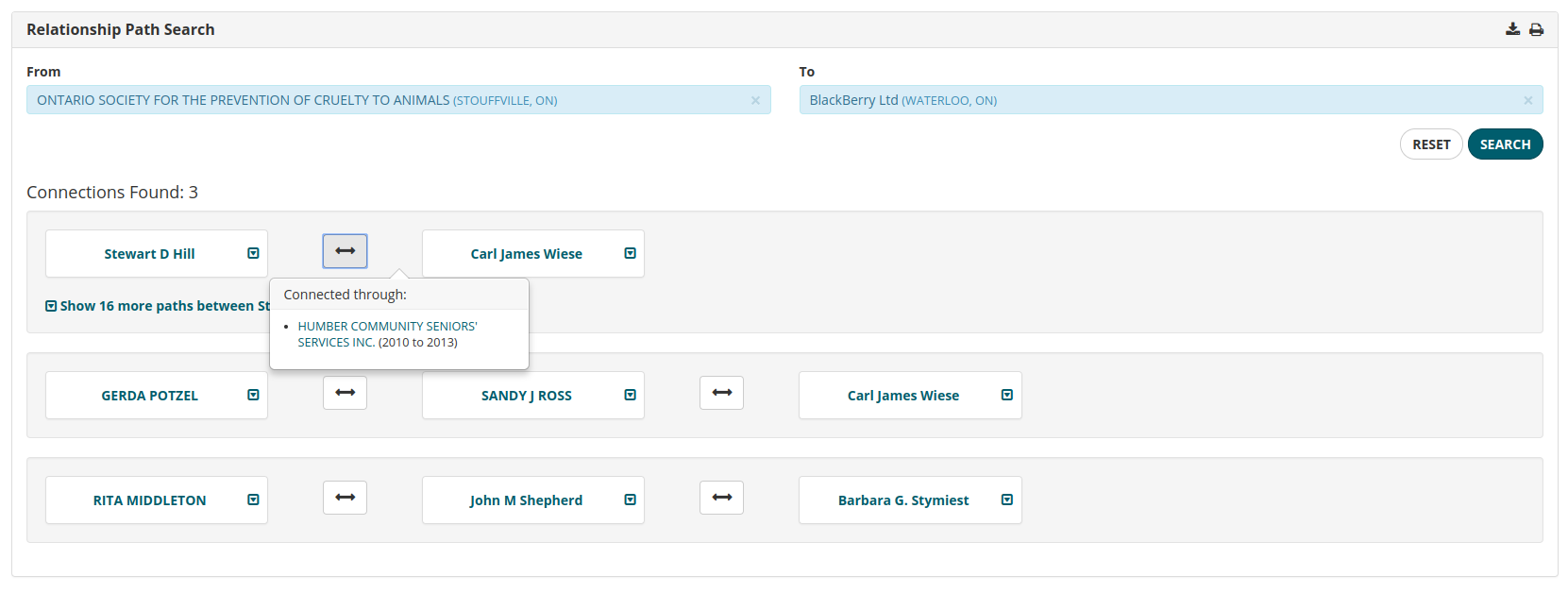

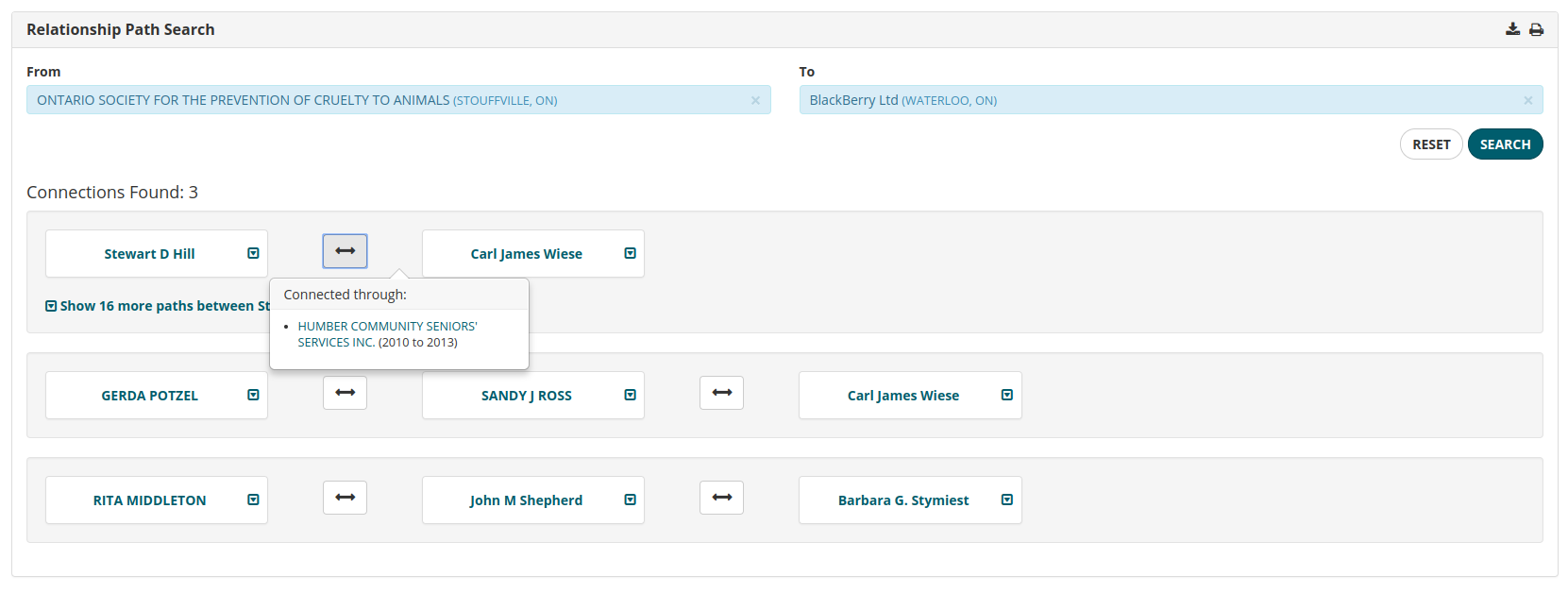

In the example shown below, a prospect researcher at the Ontario Society for the Prevention of Cruelty to Animals (ONSPCA) wants to determine if anyone on his board of directors has a connection to BlackBerry (formerly Research in Motion). He has identified BlackBerry as a potential corporate donor and is in the process of determining the best way to approach it for a gift.

Entering the name of the charity in the left field and the name of the company in the right field and pressing search will quickly return all connections identifiable by CharityCAN.

This Relationship Path search revealed 2 connections between the ONSPCA and BlackBerry. Clicking on the connection arrow reveals the nature of the connection. In the example above, we can see that Stewart Hill (ONSPCA) and Carl Wiese (BlackBerry) are connected through their time as board members of Humber Community Seniors’ Services.

Here’s another example.

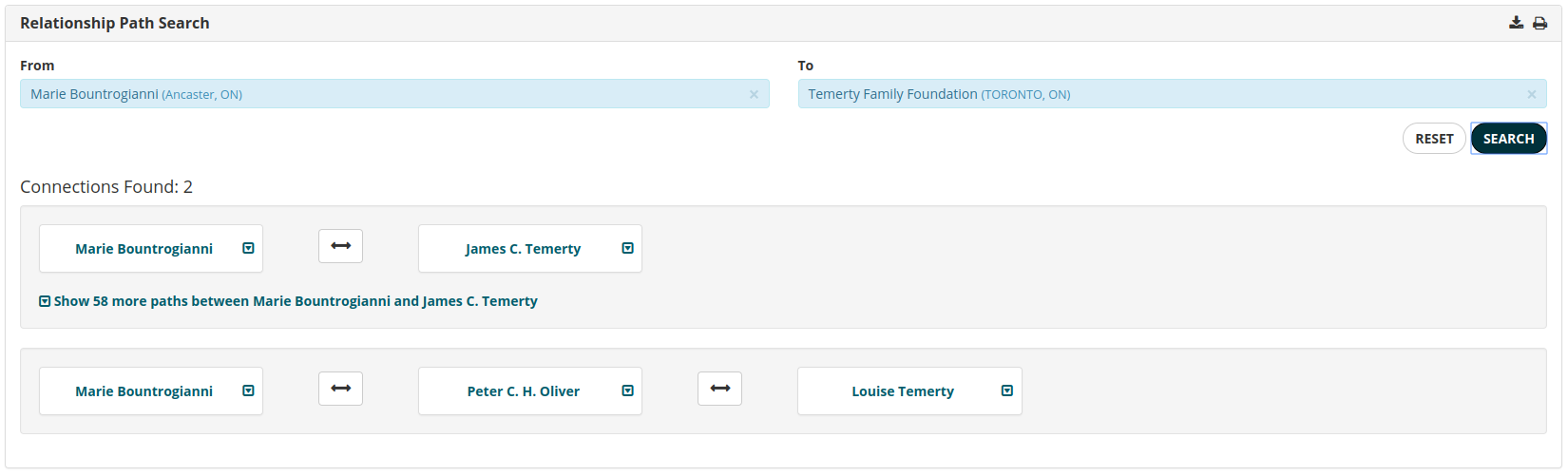

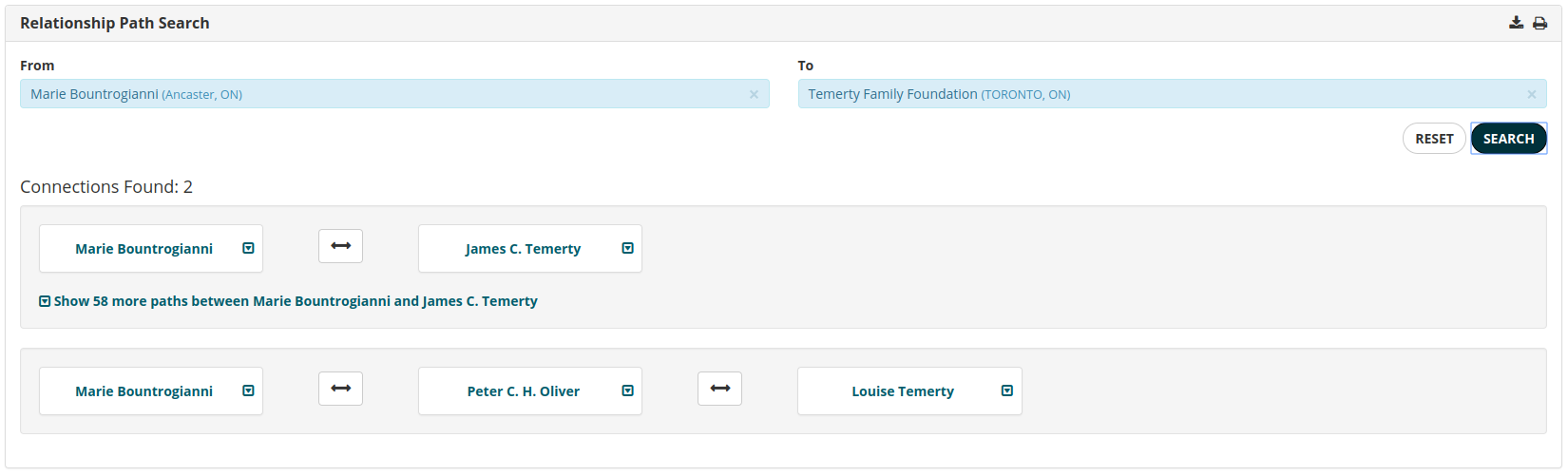

Hamilton Health Sciences Foundation, want to determine if one of their donors, Marie Bountrogianni, has a connection to the Temerty Foundation, a foundation they would like to approach with a gift request. They are hoping Marie can make an introduction. By entering Marie’s name in the left field and Temerty Foundation in the right field, they can easily determine if Marie has a connection to the foundation,

In this case, the search revealed two connections between Marie Bountrogianni and the Temerty Foundation, including a direct connection between Marie Bountrogianni and James Temerty.

Relationship Paths builds on CharityCAN’s powerful Relationship Mapping functionality to provide users a quick and direct way to search for connections among people, charities and companies. For more information, please contact us or sign up for a free trial!